"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

09/06/2016 at 22:24 ē Filed to: Credit

2

2

7

7

"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

09/06/2016 at 22:24 ē Filed to: Credit |  2 2

|  7 7 |

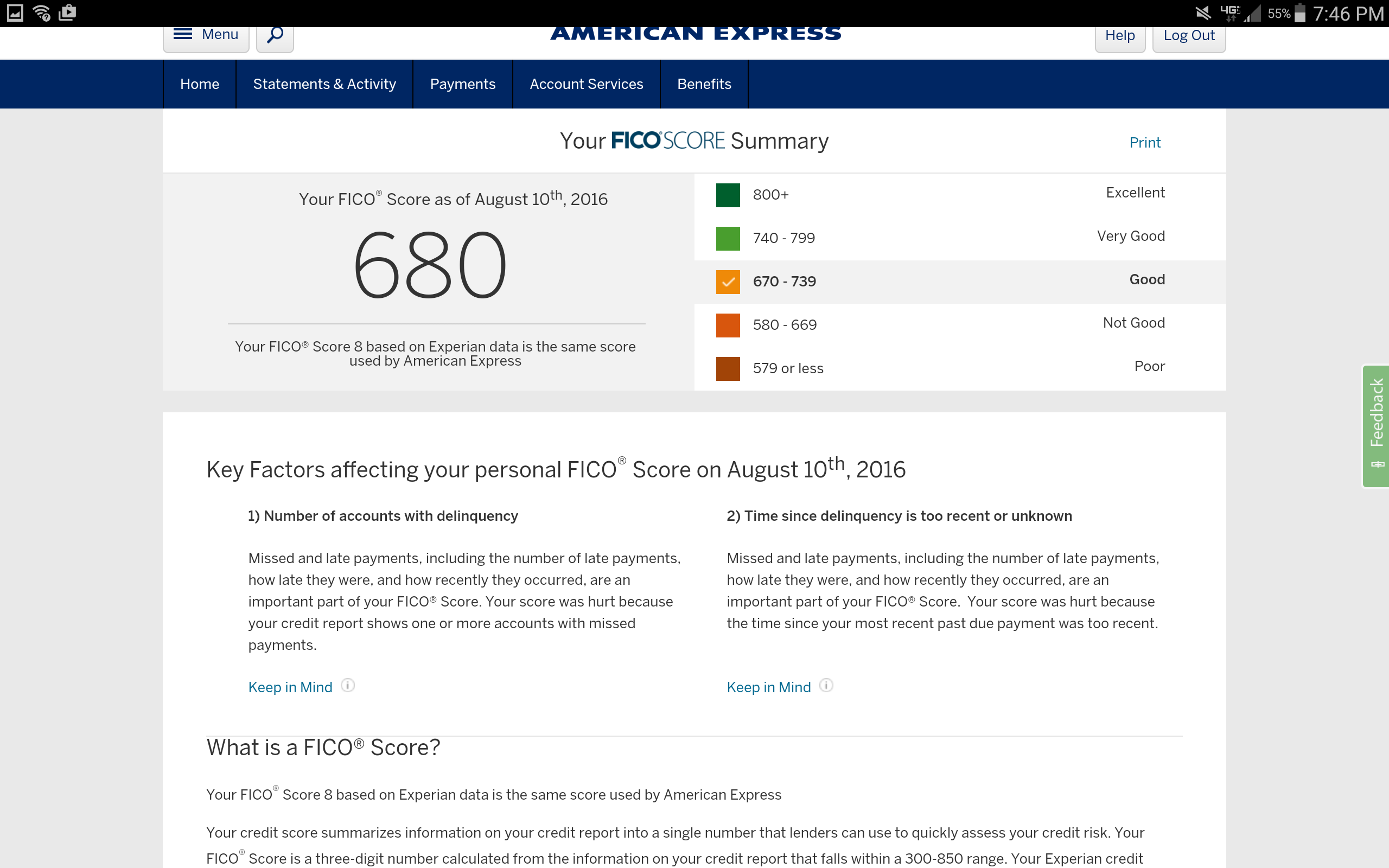

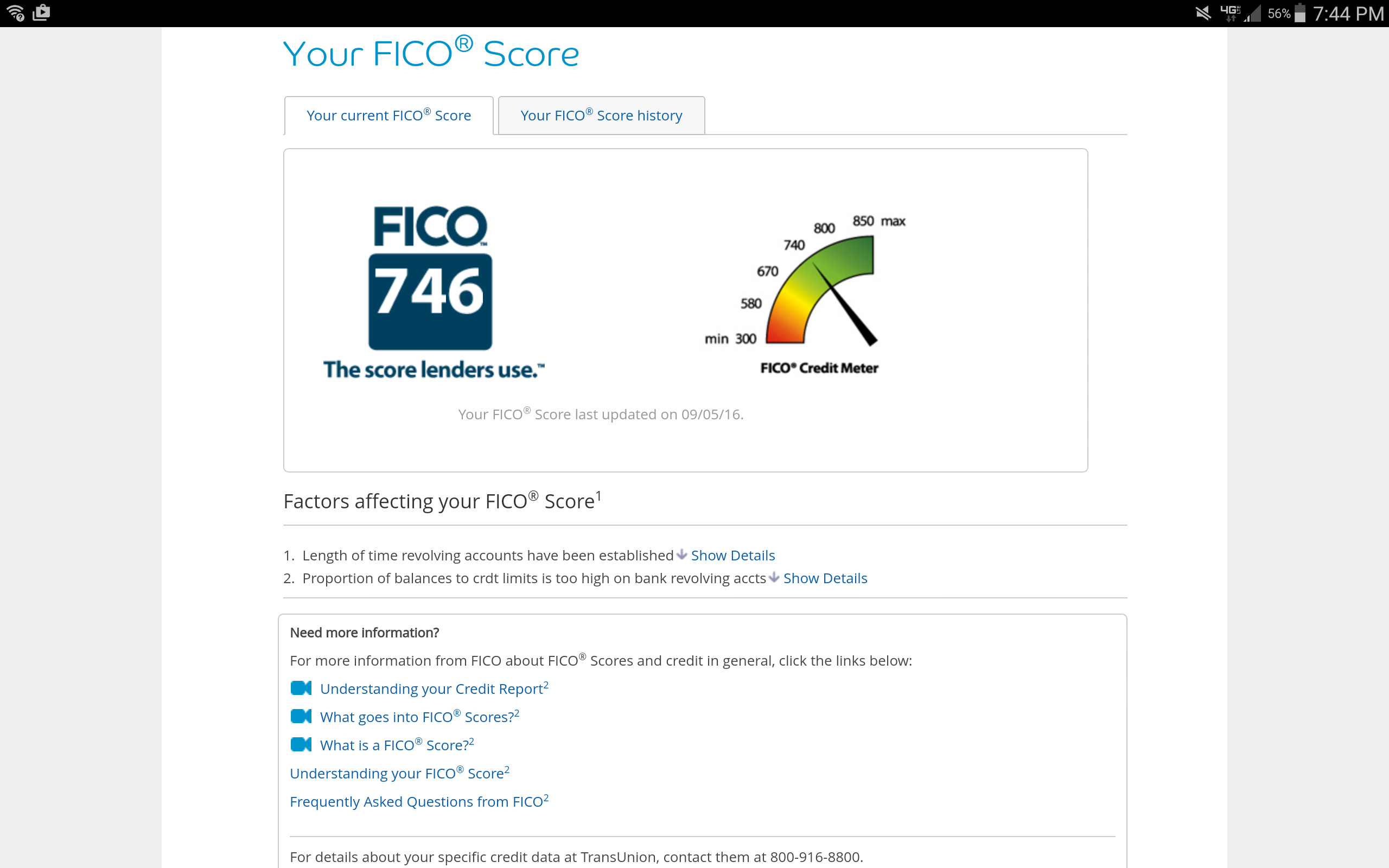

I wonít get into the story, but my Credit Union dropped the ball for the first time ever for me. Luckily, I have been with them for over a decade (since I started high school) and Credit Karma alerted me that my score had dropped over 100 points between June and July. Hereís the score change from August to September though:

It will probably take until the first week of November before my credit score gets back to where it was but Iím very happy with how well (and quickly) my Credit Union handled the flub up. Iíll say this, no matter what they tell you about insurance, banking, or business, long time loyalty pays itself off over jumping around trying to catch the best deals at the time.

I did freak out, internally though, because I need to get ready to purchase a house in 18-30 months in order to stick to my plan, but most of all I need to rework my insurance in February 2017 (when my speeding ticket from Feb 2014 is removed from the record) and this would have cut my nuts off.

getFuckedHerb

> Wobbles the Mind

getFuckedHerb

> Wobbles the Mind

09/06/2016 at 22:28 |

|

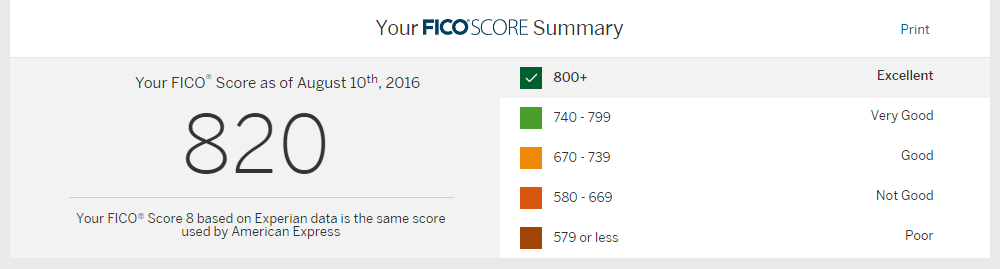

Glad you caught it and got it worked out. Amazed at how many people donít know their score, or know itís sub 800 and donít care. Amex/Discover which let you see your score every month are great.

Mine is a little lower this past month, I put a bunch on my credit cards, I expect next month when they realize I also paid it all off itíll go back up to 835ish.

Funktheduck

> Wobbles the Mind

Funktheduck

> Wobbles the Mind

09/06/2016 at 22:31 |

|

Nice catch. I peek at mine pretty often.

Chasaboo

> Funktheduck

Chasaboo

> Funktheduck

09/06/2016 at 23:41 |

|

I never look at mine. All the stupid stuff Iíve done, itís probably in the 5s.

Tohru

> Chasaboo

Tohru

> Chasaboo

09/07/2016 at 00:28 |

|

I hit a really bad stretch financially for awhile - lots of late or missed payments, some medical stuff in collections. Mine hit 390.

Birddog

> Wobbles the Mind

Birddog

> Wobbles the Mind

09/07/2016 at 03:00 |

|

Good to hear theyíre making good. Or as good as possible. My CU actually has Monitoring as a freebie.

Credit Unions are often overlooked. A lot of them run like a Co-Op and can do amazing things.

haveacarortwoorthree2

> Wobbles the Mind

haveacarortwoorthree2

> Wobbles the Mind

09/07/2016 at 09:55 |

|

I hate credit scores. I get dinged because I only have one card and it usually has a high monthly balance because my business travel expenses go on it, which means I am using a substantial part of my credit limit. But what doesnít get factored in is that the balance gets paid in full every month, so the real usage of my credit limit is zero. So I literally have to get another credit card to increase the amount of debt I can incur so that my credit score goes up.

TheDudeAbides_(version 2.0)

> haveacarortwoorthree2

TheDudeAbides_(version 2.0)

> haveacarortwoorthree2

09/07/2016 at 10:31 |

|

Your problem isnít (only) that you only have 1 card, itís that that 1 cardís limit is far too low for your usage patterns. If you find yourself often using up 35% or more of the limit with business travel that will be paid off immediately each time, you would be well served calling the bank that issued the card and asking them to increase your limit. But make sure you ask if they will need to do a hard or soft inquiry to offer an increased limit. If theyíre going to do a hard inquiry anyway, it might be better to just get a second card instead (depending on the benefits of your first card and whatnot). I know some will do it with a soft inquiry, others wonít (Iím looking at you Chase!).